Companies of any size now can easily start automating repetitive work to free up their teams from routine, low-value tasks to focus on activities of much higher value to the business. No longer is automation reserved for enterprise companies with dedicated teams of developers.

Here is a list of 10 things we believe every debt management and insolvency company should automate, regardless of their size or software already in use.

1) Welcome sequence

You need to capture interest and build trust, and the welcome sequence is a great way to do that. You can show yourself being corporate and serious, or you can be funny and friendly. Regardless, you must always introduce yourself and your brand to the customer.

Once a new lead comes in, immediately send them a text or an email and explain why they should trust you, what to expect next and engage them by asking a question.

Your welcome sequence should be automated, sending multiple emails and texts over a few days, guiding them through the process of becoming debt-free.

2) Contact centre integration

The days of manually assigning inbound leads across team members are hopefully over. It's even more challenging with remote teams since you don't want to assign a new lead to someone who'll be on a call for the next hour.

With a constant flow of new leads, you should be using a modern contact centre platform. You can then put new leads into a high priority bucket and present them to agents as soon as they're ready to make the next call. This means you can catch your leads while they're still reading the "thank you" page on your website, increasing your conversion rates.

This process is easily scalable and doesn't require tracking individual agent's availability, lunch hours or days off. It works great, regardless if you have a team of 5 or 50 agents. But make sure you avoid automated dialling and dial your inbound leads in preview mode, giving agents time to prepare for a call.

3) Best time to call

If the new lead doesn't answer the phone, you should always follow up with a text message and ask for the best time to call them.

Ideally, you should offer customers a mobile-friendly link to pick the best time to call. Once submitted, it should be synchronised with your CRM by creating a task or creating a future callback directly in your contact centre platform.

4) Document generation

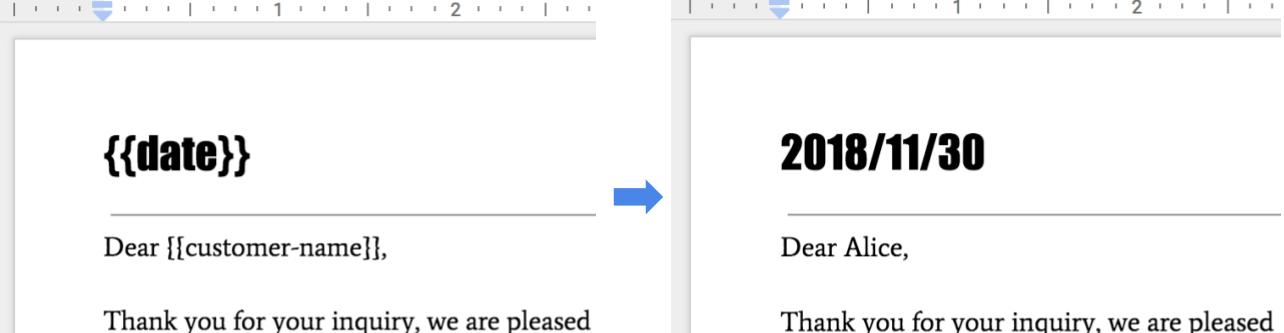

Please, don't ever fill out templated documents manually. You've most likely seen first-hand where a copy-paste job went wrong, with an incorrect date, address or name ending up on a document.

What you should do instead is create a templated document, with fields such as {{date}} and {{customer-name}}. Then, based on a customer's reference number, you should have a new document automatically generated for you with those two fields replaced with actual values.

Additionally, the generated document can be automatically sent to an email address on the customer's file, rather than someone doing all these steps manually.

Where necessary, you should create an approval task for someone to review the generated document before it's automatically sent to the customer.

5) Customer status change notifications

Your teams should always be aware in real-time when leads are progressing along the funnel or when there are material changes to your existing customers.

For example, a team might be waiting for a signed Letter of Authority (LOA) before approaching the creditors. As soon as the signed letter comes in, your team should receive instant notification via chat or email. Then, a new task should be waiting for them with details on the next steps to do.

6) Document collection

Stop asking customers to send you documents to info@yourcompany.co mailbox and for some unfortunate employee to go through that pile and put it in the correct folders.

Provide your customers with a secure link to take pictures or upload documents via their mobiles. Once uploaded, these should automatically end up in the customer's folder in your CRM, Google Drive or your document management system.

7) Automate valuations and repetitive work

With Individual Voluntary Arrangements (IVA), insolvency practitioners often need various proofs, such as council tax band charges or a car valuation.

Don't forget we live in the future, so instead of someone gathering all this information manually, you can have a digital robot 🤖 (not kidding!) carry out the same work. We're serious, digital robots are a thing these days, and they're much easier to run than you might think. They can save all that information into a PDF document and put it in the right place for you.

8) Task management

How many times have you seen teams miss tasks or pass requests between departments via emails, which are then lost and forgotten without any accountability? What about managers being unaware of the outstanding amount of work in their teams?

You need to manage recurring work in a structured way with tasks, ideally created automatically based on system or customer events.

Did a customer miss a payment? Start a workflow that will send a reminder email and create a task to handle this.

Mapping out and automating business processes will make sure nothing ever gets missed, and outstanding work can be easily managed and tracked.

9) Refer a friend

In the personal insolvency space, asking customers to refer a friend is a great way to acquire new leads at an affordable price. Many companies offer £100 - £150 for customers to refer their friends, which is often cheaper than existing marketing channels, but it also greatly benefits the customer.

Create an automated campaign that will send "refer a friend" text or email on days 1, 30 and 90 after converting your lead.

10) Customer review invitations

We're surprised at the number of companies missing out on this simple trick to increase website traffic and improve their business results.

Did you know that customers search for your business online and check your company reviews, and if they can't find any, it hurts your conversion rates and search engine rankings?

Not only that, but online reviews make up 15% of how Google SEO ranks your business in search results.

But while you might be sending out review invitations already, it's not enough!

Whether you receive a positive or negative review, it's important to respond to that review to show your customers and search engines your commitment to customer satisfaction.

33% of customers that received a response after posting negative feedback turned around and posted a positive review, and 34% deleted the original negative review.

Not only that, but Google officially says:

When you reply to reviews, it shows that you value your customers and their feedback. High-quality, positive reviews from your customers can improve your business visibility...

Interesting, huh!?

Make sure you automatically send customer review invitations after providing the customer with a solution.

Great, but where to start?

We hope you've learned something new! Here's the list again:

- Welcome sequence

- Contact centre integration

- Best time to call

- Document generation

- Customer status change notifications

- Document collection

- Automate valuations and repetitive work

- Task management

- Refer a friend

- Customer review invitations

To start implementing this, speak with the person responsible for technology in your company to understand the costs and how long it'll take.

Another option is to look at a solutions provider specialising in business automation.

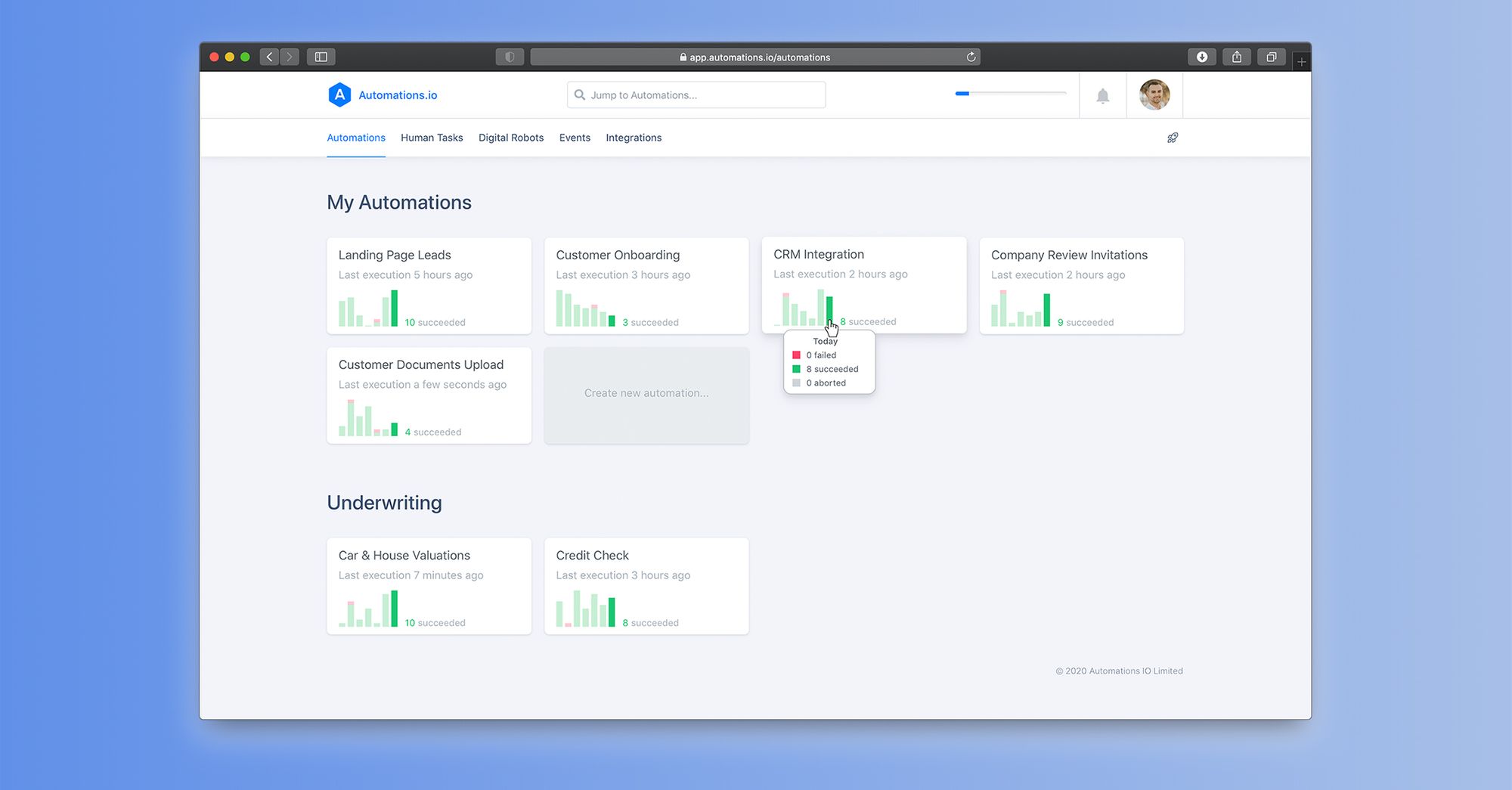

There's also Automations.io, a platform focused on helping debt management & insolvency companies automate manual work, save time and increase productivity. It complements your existing tools, so there's no need to replace your current systems, and you can go live in days instead of months of software development.